Hello there,

Are you struggling with which investment option is better for you as per your age? Or Have you just started a job or new to investment and don’t know where to start?

Then this is the right place for you.

First let’s see why investment option are important?

During this pandemic when the world came to a sudden halt and world’s economy was

suffering, People with investment were the only one with least worry about feeding their families.

- Just by storing money in lockers will reduce its value, Investment option helps our money to grow.

- It secures our retirement.

- Investment option helps us to achieve our future goals.

- Today’s investment will boost and expand your business tomorrow.

- It acts as a safeguard during uncertainties.

Enough with the advantages, now let’s see where to invest?

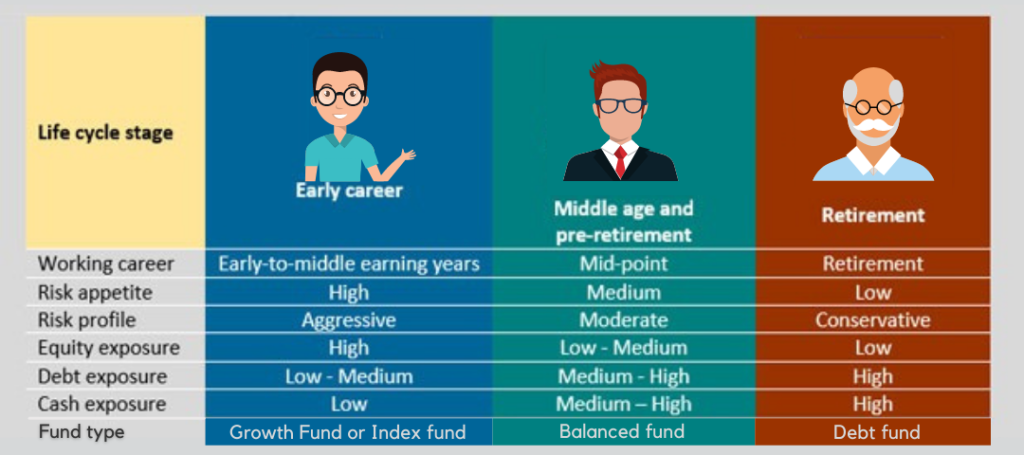

Generally, Investment Option decisions always depends on your Availability of Finance and Risk Appetite.

Someone who’s in their 60’s cannot opt for risky stocks as their income scope is limited when compared to a person in their 20’s.

List of Investment Option:

- Share Market or Direct Equity:Investing in share market is easy. All you need is a Bank account and a Demat Account, but it comes with great risk if you don’t have any proper knowledge about the market. A common misconception is that share market is nothing but a Gamble.

Before trading in direct equity or derivative you must have knowledge about Technical and Fundamental analysis.

But, if you don’t have any knowledge and still interested in stock market then you must try next investment option. - Mutual Fund:It is one of the smartest Investment Option. Mutual fund is a pool of money that is created from various investors. The money collected is then managed by Fund managers who are experts in Technical and fundamental analysis.

This money is divided into different asset class like equity, derivative, debt, government bonds, money market instruments etc.

So the next big question is…

Which type of scheme should you choose and for how long?

For a Newbie, always opt for SIP and not Lumpsum investment

In SIP’s you can get NAV benefit and if you are investing for long terms(i.e.more than 3 years) then be ready to get return in TIMES.

Now with so many schemes made available by banks which one to choose?

A person of early age should invest in Growth Fund or Index fund.

A person of Mid age should invest in Balanced fund that is a proportion of Debt and Equity fund.

A person of Old age should invest in Debt fund.

- Insurance: The Early you start, the more you earn.

Family Assurance and their safety is important to everyone. In most of the families it has been seen that the one who earns the bread and butter is responsible for all expenses. Now in case of any crisis only insurance can provide you financial support. Every individual should opt for a term insurance so that in their absence, their family don’t fall into a deficiency of food.

It also comes with different protection, based on your goals. - Fixed Deposit: Another Investment Option is Bank fixed deposit. In fixed deposit you get a predefined interest on your investment. It is for people with less risk taking abilities or the older generation, but as a newbie you should not opt for FD, and take risk to earn

more. - Gold ETF: If you are interested in purchasing metals, nothing can be better than GOLD ETF.

For all conservative investors this is a great Investment option to choose. As the name suggests it is directly linked with gold but in this case you don’t need to carry it rather it’s a document which is equivalent to your original gold.

For purchasing a Gold ETF you just need to have a demat account and a bank account and you are good to go. - Property investment: Investing in properties is never a bad idea. If you are getting a property at low price first check if it has any issues and have a survey of the area. If everything seems fine then just go for it, because the value of land never depreciates over time.

- Crypto currency: A new emerging technology has been introduced recently that is blockchain technology. Here all the process is encrypted with no middleman interface unlike stock market. The most popular cryptocurrency is Bitcoin whose price is reaching new heights every week.

But not everyone can opt for Bitcoin because its price is quite high now, so you can invest in other currency also like Platin coin, Ethereum, Dogecoin etc. - Other investment option: Apart from all what we discussed you can go for National Pension System (NPS), Public Provident Fund (PPF).

For senior citizen Senior citizen savings scheme (SCSS), Pradhan Mantri Vaya Vandana Yojana( PMVVY).

If you are still confused then just opt for insurance as an Investment option because it will definitely give you one return that is safeguard your family.

Now where are we in this picture?

If you are ready to have any kind of insurance just contact us.

We are associated with the most trusted brand TATA to provide you insurance with minimum premium and fastest settlement ratio.

https://shubhamcommunication.com/insurance/

So, Tell us in the comment section which Investment Option you like the most.